Dating titans, Match Media, explain how they used fast insight into the coronavirus pandemic to pivot in the right direction.

“This research has been able to show us what trends are actually going to outlast this pandemic."

Match Media Group is a one-stop-shop for brands to leverage the audiences of some of the top dating platforms in the world. Its leading portfolio includes the likes of Tinder, OKCupid, Plenty of Fish, Hinge and Match.com.

Working closely with businesses across sectors, the teams are revolutionizing the dating landscape, taking a “mindful” approach to advertising – ensuring only the most relevant and valuable content is shared with its audiences. They do this by starting with data.

In the wake of the coronavirus pandemic, the online dating scene like so many others was turned on its head. With consumers being forced into lockdown, the behaviors and attitudes of singles globally was something their research teams needed to keep a close eye on.

Knowing where to shift their attention for continued success in the advertising sales space meant not only tracking fast-changing trends, but identifying new opportunities emerging.

The challenge

Knowing where to pivot in a crisis.

Singles searching for connections are everywhere – and they always will be. From entertainment to alcohol to beauty to retail, it’s hard to find a sector whose audience doesn’t feature across the dating portfolio.

Combined with their internal data, the Match Media teams rely heavily on GWI’s core attitudinal and behavioral research across 46 countries for insight into these diverse, global audiences.

“We use these insights to help our sales team go after new accounts or tell a better story as to how our consumers are behaving, thinking and buying”, says Divya Lakhati, Market Research Director at Match Media Group.

These stories help their partners shape better advertising campaigns – ads that are centered 100% around the consumers they’re targeting and providing a benefit for the members.

“Our best campaigns are based on audience insights”, says Vicki Shapiro, Vice President of Marketing. “Something as simple as knowing our audience like a free shipping offer can make a big difference. We can take that to our clients and say: ‘Do this and you’ll see better results.’”

But in the midst of a global pandemic, the teams needed to know what was changing – and crucially – what changes were going to stick.

“Our partners come to us because they see us as the experts in the industry”, says Vicki. “Before making a decision around advertising, they ask us: ‘what can you guys tell us to help us get a leg up on this audience?’”

To keep answering this question in the face of radical change, they needed to know more:

- Was engagement increasing among their audiences?

- How was the mindset evolving?

- Were new audiences emerging?

- What did their audiences want from their new experience?

- What support or guidance were they seeking?

- How are their purchase influences or habits changing?

Here’s how they went about it.

The action

Leveraging fast research to tell the right story.

“Even in isolation, people crave human connection”, says Divya. “We’re seeing app downloads spike significantly in countries where stay-at-home orders were implemented.

Tinder had more than 3bn swipes. That’s more than any on a single day in the company’s entire history.”

Overall, the average number of daily messages sent across Match Media properties in April was 27% higher than the last week of February. For users under 20 years old, it was 35% higher.

Witnessing this spike in engagement across all platforms, the teams knew there was a wealth of opportunity their partners and sales teams could tap into. The next step was finding out what these were.

Shifting their attention to GWI’s ongoing research into the impact of coronavirus on the global consumer landscape, they could apply their own audiences and brands, pinpointing the changes that were happening in terms of behaviors, attitudes and more.

With four waves of research released so far from GWI, from mid-March, the data now covers 20 markets globally and offers up a unique look at how consumer mindsets and habits have been changing during the crisis, and what changes are likely here to stay.

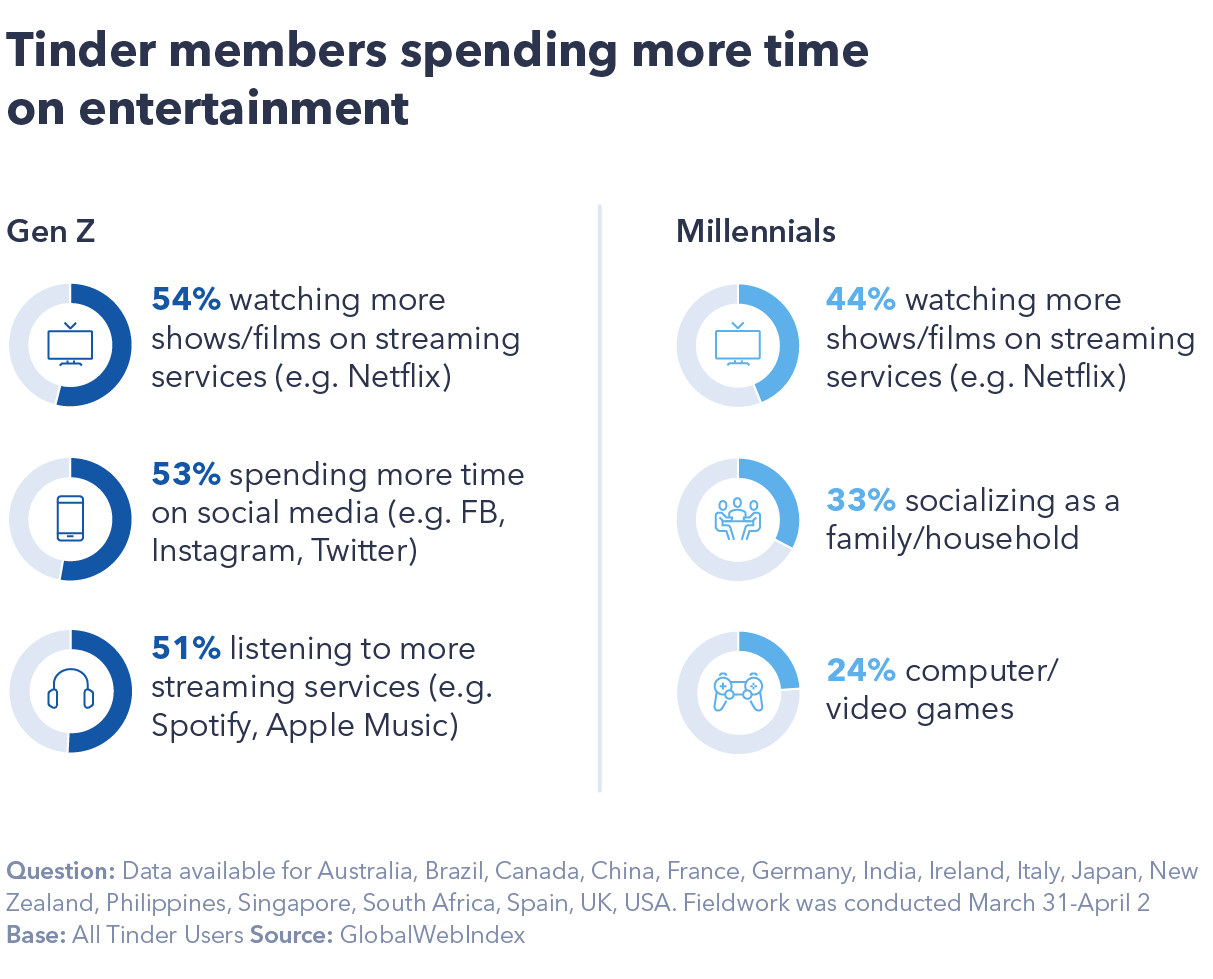

“When looking at research, we look for trends that will affect the story we’re telling”, says Vicki. “Now, we need to know what trends will actually outlast the pandemic.” One finding they uncovered was that Tinder users were spending more time looking for ways to stay entertained.

Having this global view was crucial. With lockdown measures differing between countries and being modified all the time, there was no plug-and-play solution.

Using this data, they could identify the new audiences and trends that were emerging, and what part of the journey was most important.

“We’re all about uncovering that member’s journey”, says Vicki. “Do they prefer to text or call? Do they use audio or video? Who do they turn to for wardrobe advice? Do they choose an activity or just have a chat… We use data to unpick every step along the way. That’s how we help insert our partners where it’s most relevant for them.”

Using the findings, the Match Media team created data-led newsletters, giving their partners and clients the insights to stay clued into singles during lockdown.

One obvious trend they needed to keep a close eye on with their audiences in lockdown globally was video dating, or ‘dating from home’.

Video dating in the new normal.

While before the pandemic, only a small percentage of members were open to video chatting, the opportunities to connect via video are now endless. A key question the team needed to answer was whether this trend would outlast the crisis.

The team needed to find out about user attitudes towards the medium.

- Are users willing to date from home?

- What are their fears or deal-breakers?

Once actively engaged in video dating, they needed to assess their behaviors.

- How long do video dates last?

- How are users interacting with video?

With these pieces of the puzzle put together, they could then focus what actions their clients needed to take in order to keep video dating fresh and engaging.

- How can we enhance the video experience?

- How can we offer more value at each stage of the journey?

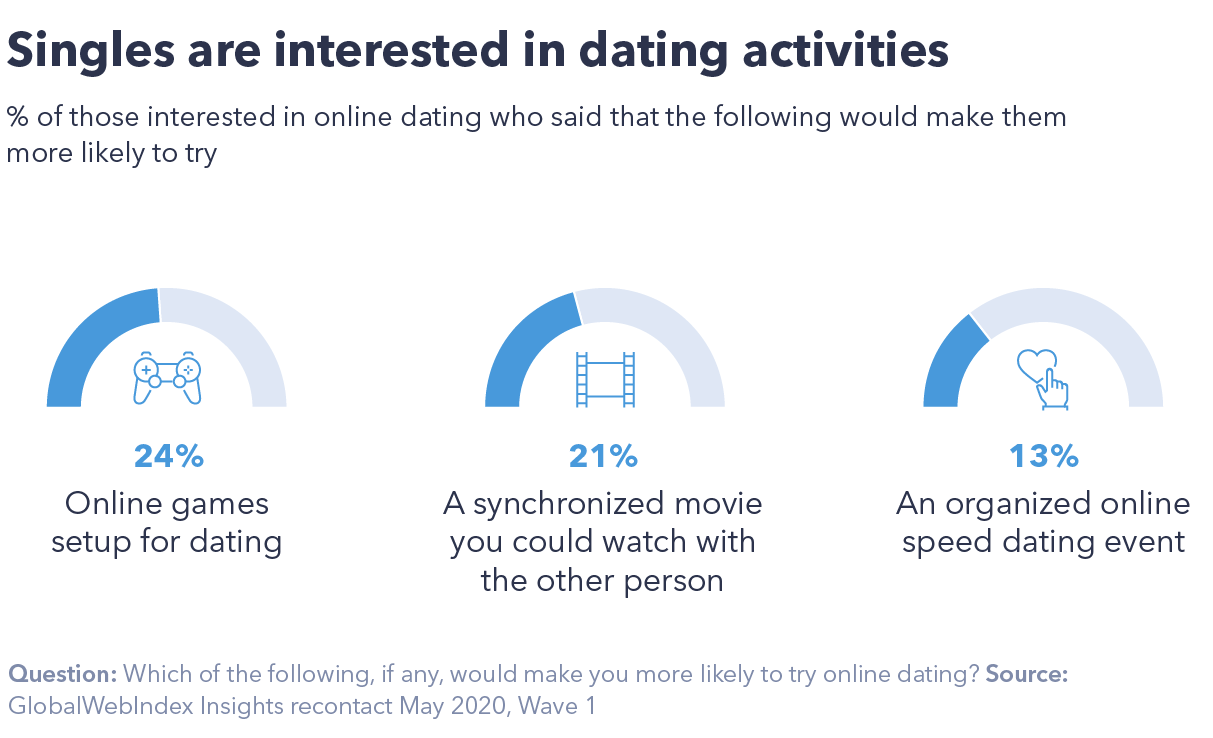

“Gen Z emerged as the group far more open to video chats than other generations”, says Divya. “31% of our audience on one platform were also down to take part in a shared activity, whether that’s playing a trivia game or cooking together.”

With this data, Divya explains the team could identify the opportunities worth going after.

“Once we found that a shared activity was a top preference, we could look at ways to tie our advertising partners into it. That’s a good example of having the data first to see what our members are looking for, then tapping into advertisers that work in that space.”

The result

Uncovering new advertising opportunities across the dating portfolio.

The global crisis has brought many brands to their knees with consumers delaying their spending and businesses being forced to close their doors. But Match Media, using the right data to guide them, knew how to drive forward.

“This is proof that staying close to your consumers pays off.”

These insights help them shed light on the big opportunities. Food delivery is one example – being able to see their users were relying on one food delivery app over another, they knew there was a story to tell for that brand.

“We found that free delivery remained the top purchase driver for our members, both pre and during covid-19”, says Divya. “A new finding for us from GWI’s wave 3 results was that Gen Z wanted to purchase from brands and services that took a stand to help people during the pandemic. Brands that do this will make gains in terms of customer loyalty post-pandemic.

So when a potential partner came to us with an opportunity to not only promote their free delivery service, but their efforts to support a relevant charity, we knew it was a perfect fit.”

Fitness is another category that is top of mind – seeing that a lot of their users aren’t planning to return to the gym anytime soon, there’s a clear demand for home fitness which is set to continue.

Not only this, for one of their top dating apps, home appliances and personal electronics were revealed to be high on their radar.

“It’s about finding out what those high priority categories are right now”, says Divya.

“This data helps us prove that our audience is quickly adapting to this new norm.

The singles audience continues to spend and invest in themselves, and there’s endless opportunity for brands to tap into them.”

Tapping into the latest research around delayed purchases, the teams are now focused on understanding what users will be prioritizing in the new normal. How will singles be spending their time and money?

Whether the virtual dating trend will continue is yet to be seen, but for the moment it’s clear there’s no shortage of opportunity.

And while finding the right brands to partner with is key, Divya explains their mission is something bigger.

“As a brand, we help people stay connected. That’s the key lesson here: connection is a human necessity. Despite being forced apart, engagement is growing as people find new ways to connect. It’s our job to make that connection better.”

Making those connections simpler and more enjoyable means amplifying the experience for users, which is where relevant, or “mindful” advertising based on reliable insight comes into the equation.

“We’ve seen the most success on our platforms when we can help brands tell the right story”, says Vicki.

“That story should always be backed by data.”

Insight sources: May 2020 GWI recontact survey of 3,022 internet users in the UK and U.S. Singles are defined as respondents with relationship status: single, divorced, or widowed.